Bullfrog Gold Corp.

US-OTC: BFGC | CSE: BFG

Low-Priced & Leaping Upward

in a Rising Gold Market

25 Holes Just Completed in Nevada

Bullfrog Gold Corporation (BFGC | BFG) – currently trading below US$0.25 per share – represents a fast-developing opportunity in the red-hot Bullfrog Mining District located 125 miles northwest of Las Vegas, Nevada.

Bullfrog Gold has amassed a commanding land and resource position in the Bullfrog Mine Area and is leveraging a significant drill database acquired from Barrick Bullfrog Inc.

Plus, the gold is there!

Bullfrog Gold Corporation

Already, the company’s 5,250-acre Bullfrog Gold Project boasts a 43-101 Measured and Indicated (M&I) resource of 624,000 ounces of gold and 1.73 million ounces of silver at average grades of 0.70 and 1.93 grams per tonne, respectively.

And not to rest on their laurels, the company – which is led by 56-year mining vertaran Dave Beling – is in the process of expanding the known gold/silver resource by way of the drill.

An Emerging Gold Play with Enormous Potential

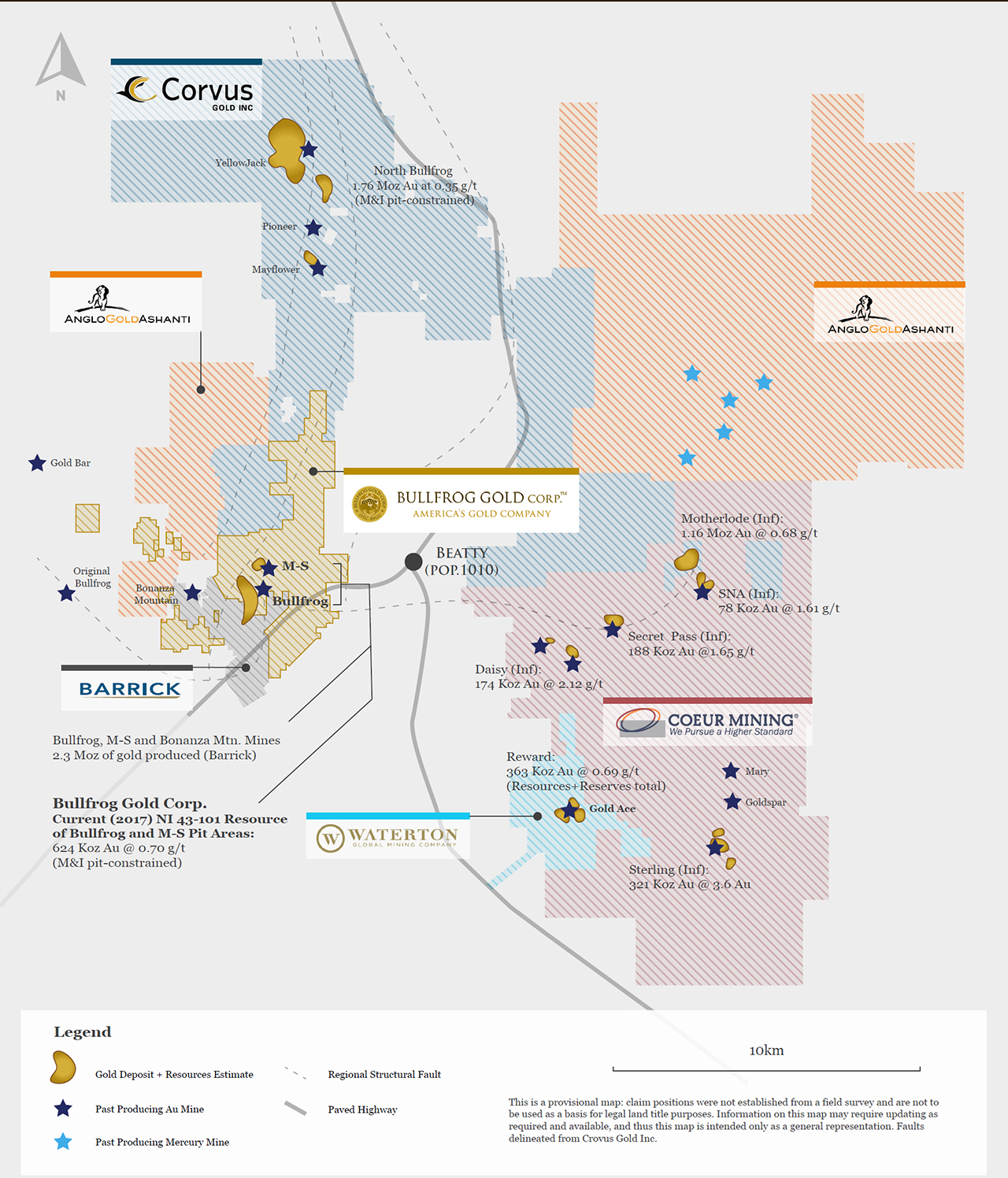

Nevada’s Bullfrog Mining District is one of the most active gold exploration regions in all of North America.

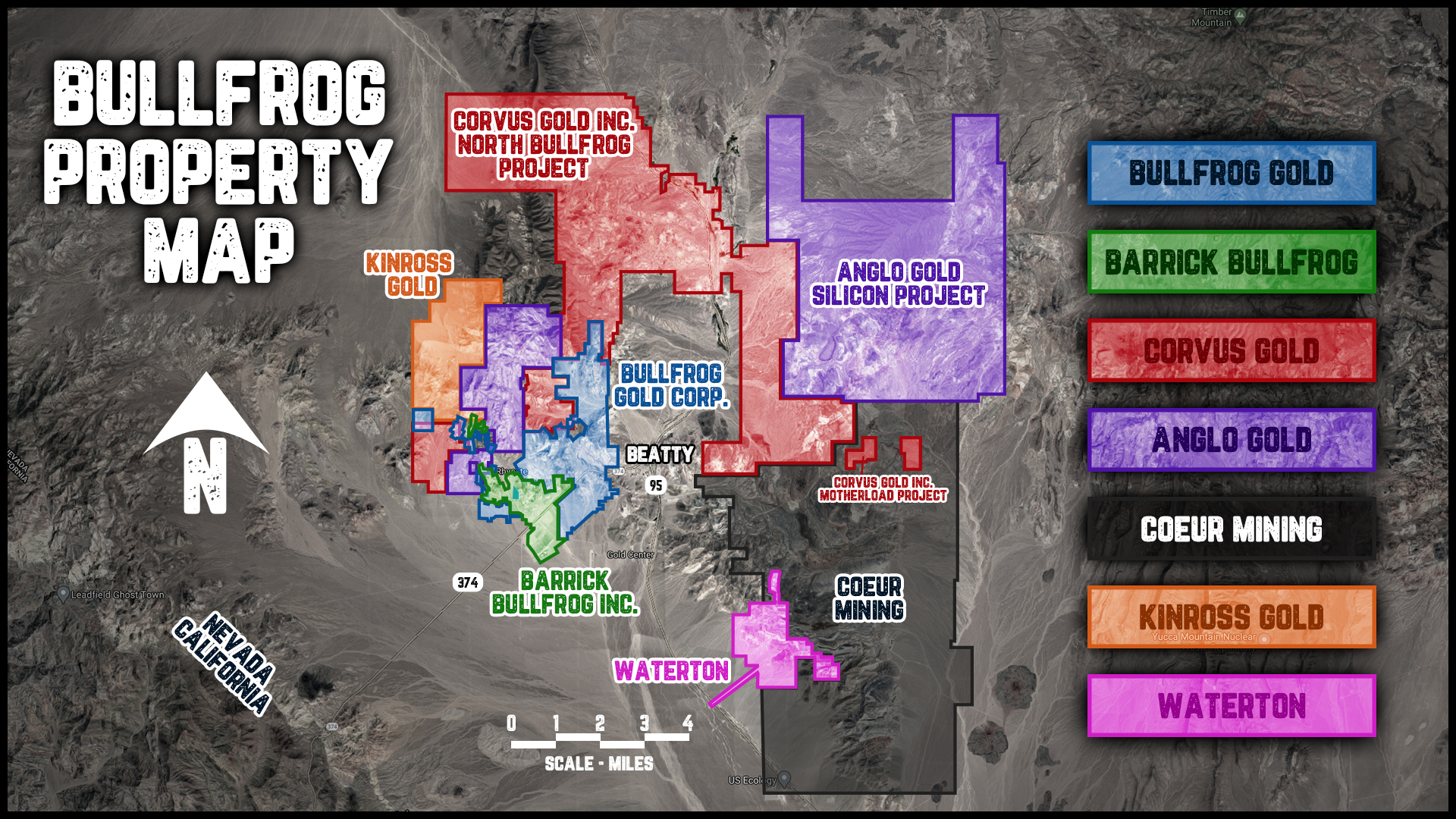

Big players like Kinross Gold, Corvus Gold, AngloGold, and Coeur Mining (which recently bought out Northern Empire for US$90 million) have all descended upon the area with industry attention heightening amid multiple drill and staking programs.

As just one example, Corvus Gold has been on a tear of late as it drills its North Bullfrog and Mother Lode targets; its stock has nearly tripled in recent months from below US$0.90 to over US$3.00 a share.

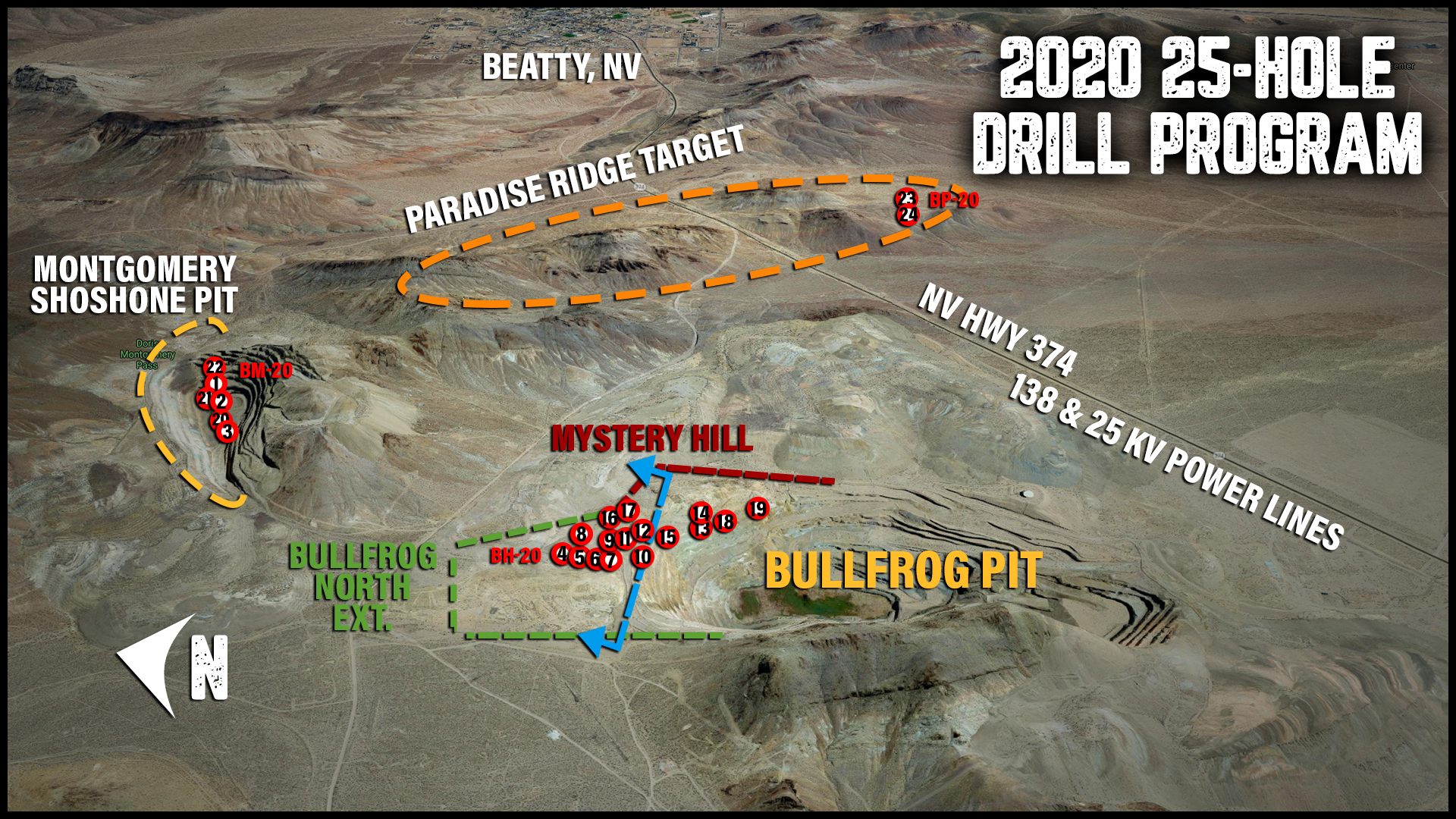

That’s excellent news for Bullfrog Gold Corp., which formed an agreement with Barrick Gold (NYSE: GOLD) and just completed its own 25-hole drill program right in the heart of Barrick’s previously producing Bullfrog Mine area.

The company’s shares are trendeding higher on the release of the first two batches of assays, which includeds several positive intersections including 8 meters of 3.22 grams per tonne gold in the Mystery Hill (MH) deposit.

Positioned for Success

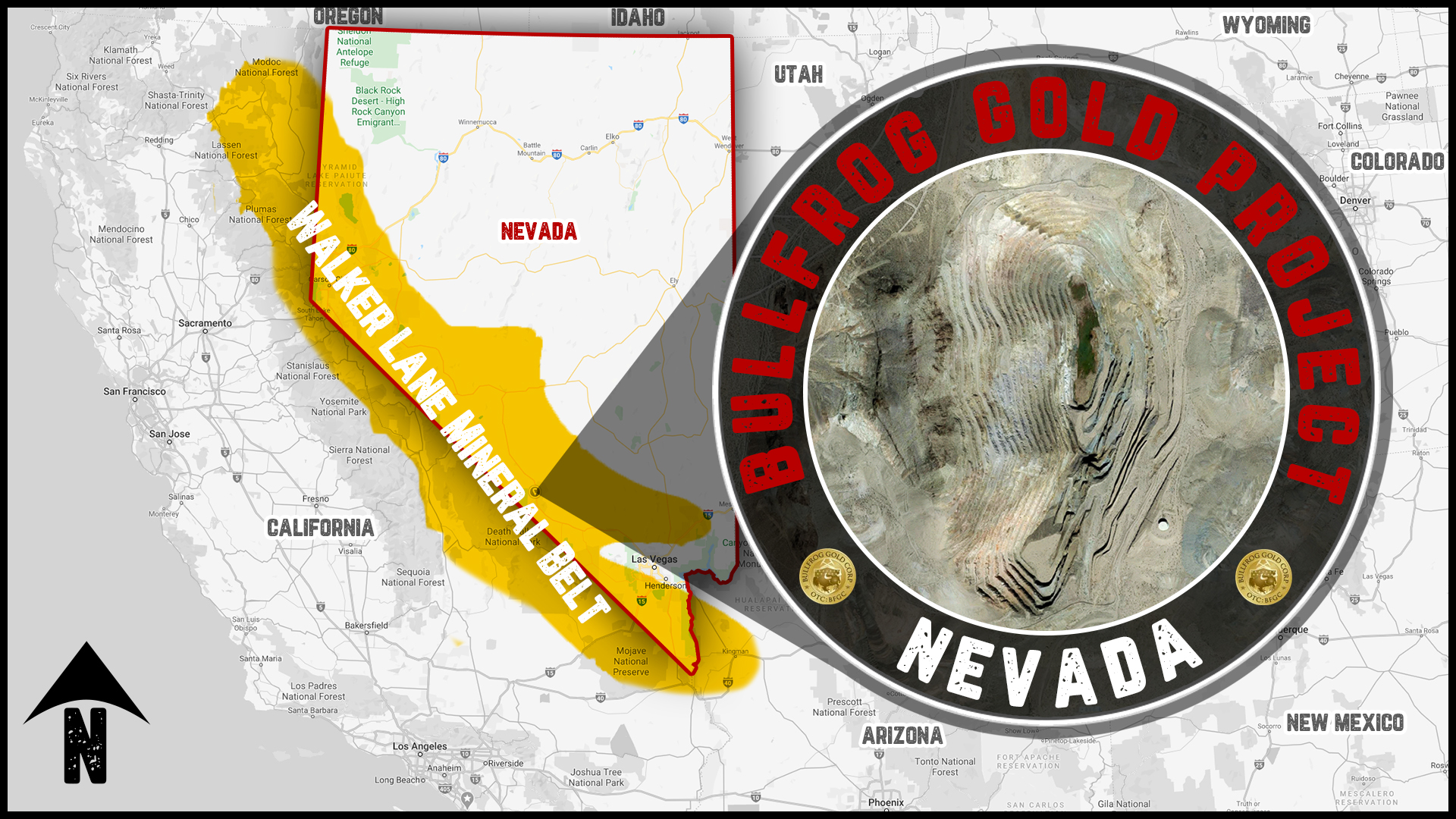

The Bullfrog Mining District is situated within the prolific Walker Lane Mineral Belt which extends all the way from northern Nevada to central Arizona.

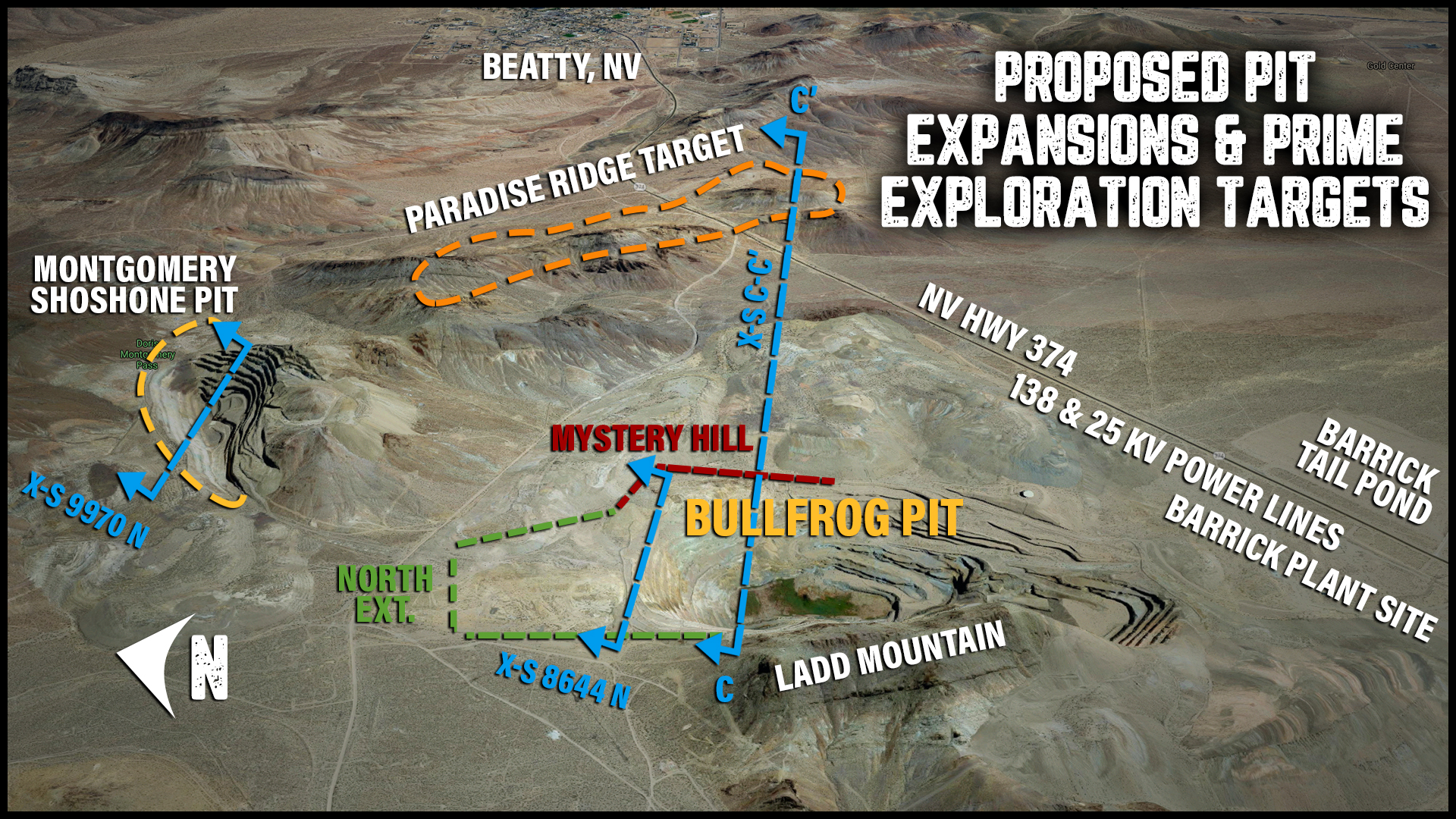

When you look at the property map below, you can see right away that Bullfrog Gold (denoted in royal blue) controls the prime land package in the heart of the area-play, including a commanding position in and around the main Barrick Bullfrog Mine area (denoted in green).

Bullfrog Gold controls what may soon prove to be the crown jewel of the entire area-play: the northern one-third of the Barrick Bullfrog pit and the contiguous Mystery Hill target.

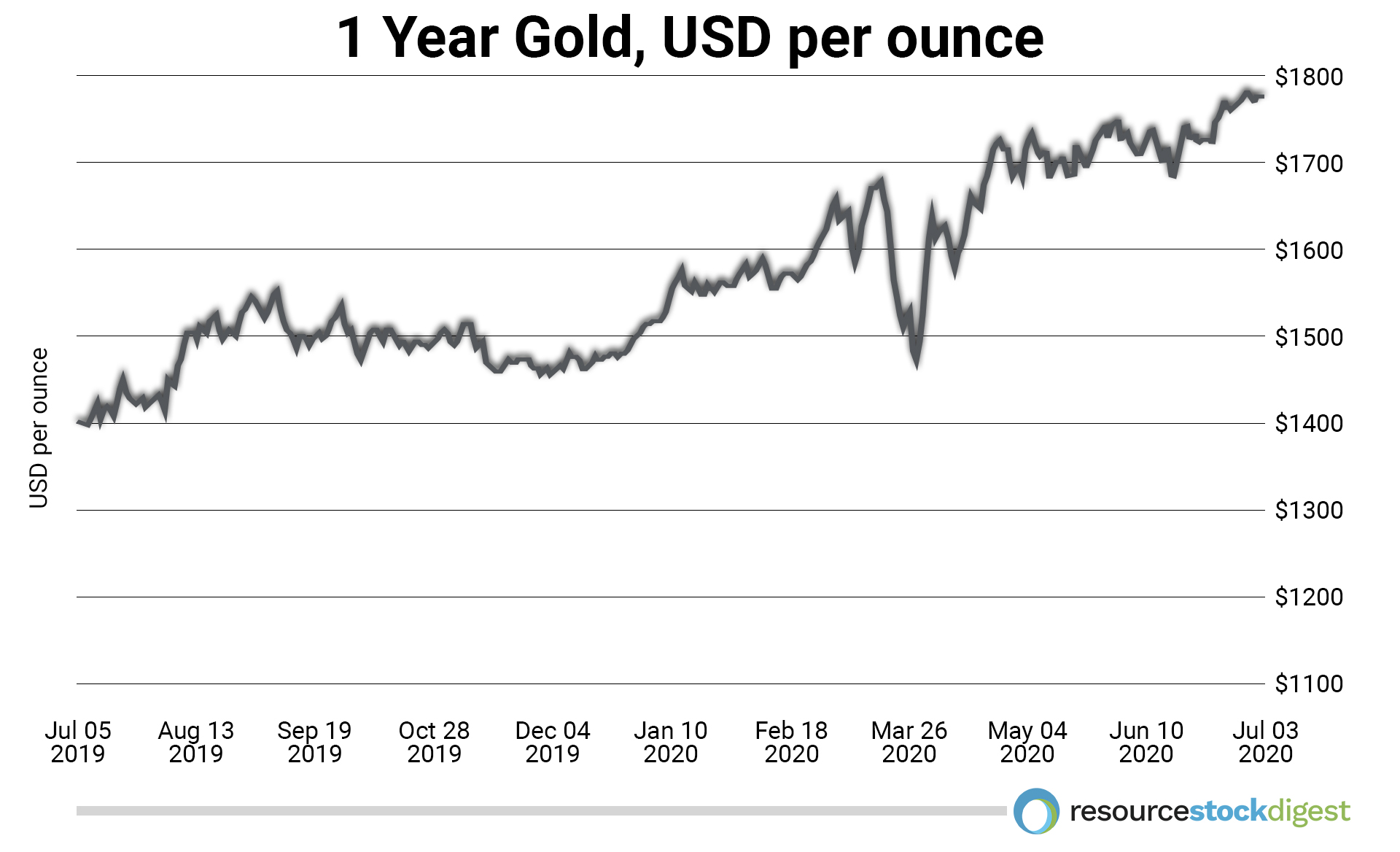

Barrick produced some 2.3 million ounces of gold and 2.49 million ounces of silver from the Bullfrog pit between 1989 and 1999. Operations were halted in 1999 due to ultra-low gold prices at that time of around $290 an ounce.

Turn the page a couple decades to today and the industry is once again laser-focused on the Bullfrog Mining District with gold trading some 7X higher at $2,000-plus per ounce.

Those 2.3 million gold ounces that Barrick extracted from the pit back then would be worth over US$4 Billion at today’s gold prices. That gives you an idea of the type of potential the area offers in today’s environment of rising gold prices.

Keep in mind also that when Barrick was pulling copious amounts of gold and silver from the Bullfrog pit, they were using conventional milling.

Bullfrog Gold, on the other hand, plans to use heap leaching, which Dave Beling has a TON of hands-on experience with, and which also should allow for lower gold/silver cut-off grades to be used in forthcoming resource calculations.

According to a recent press release: The new holes along with existing holes in the Mystery Hill (MH) area now provide much closer hole spacings that better define all resource classifications within a potential expansion of the Bullfrog pit to the northeast. MH resources will also supplement the much larger and higher grade resources in the proposed northern extension of the Bullfrog pit.

Translation: Potential now exists for a much larger deposit and, thus, a greater gold/silver haul for Bullfrog Gold Corporation.

A Brilliant Acquisition Strategy

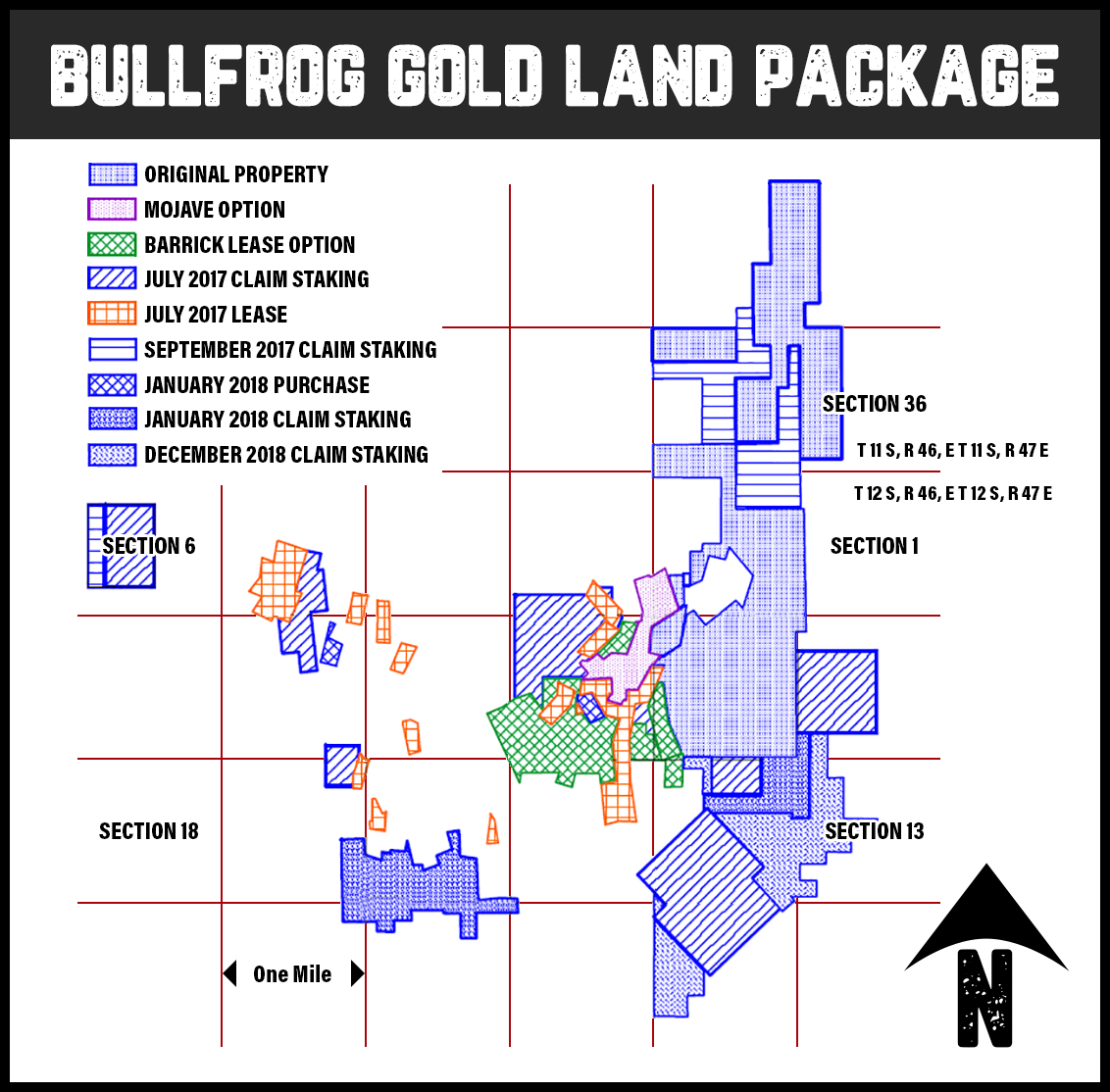

Bullfrog Gold – at the direction of Professional Mining Engineer and CEO, Dave Beling – purchased an initial land position back in 2011 and has since amassed an impressive land package comprising some 5,250 acres:

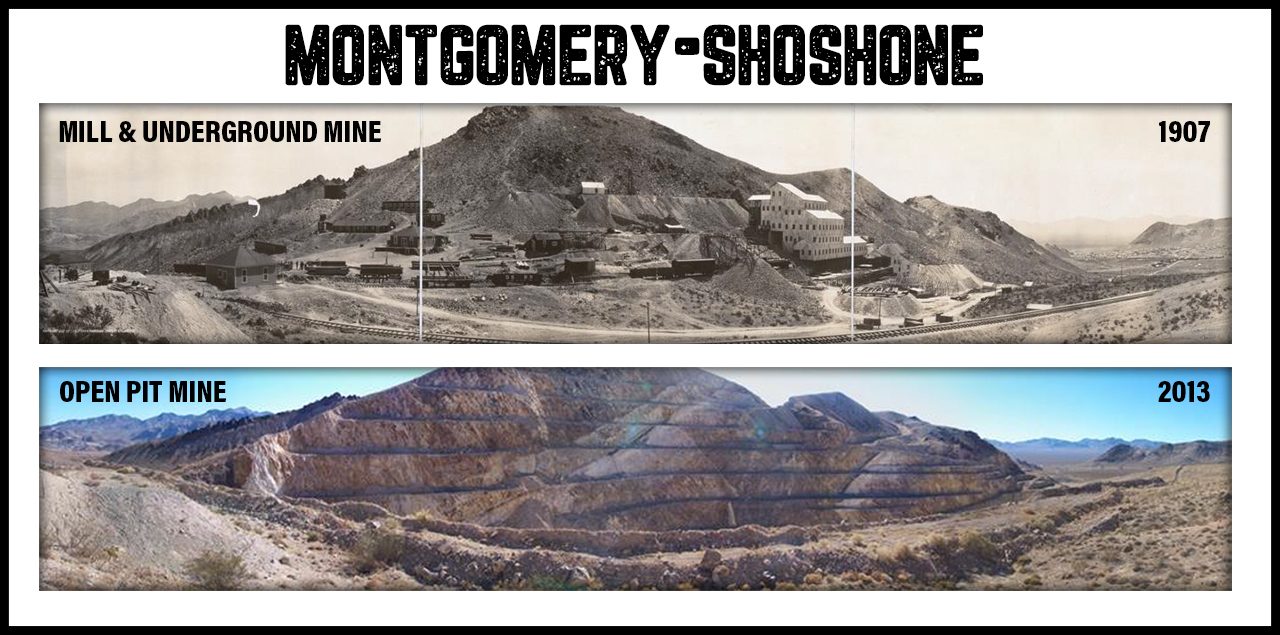

- 2014: Optioned 12 patents from Mojave Gold covering the northwest half of the Montgomery-Shoshone (MS) pit.

- 2015: Leased/Optioned 28 claims and 6 patents from Barrick which includes the southwest half of the MS pit and the northern one-third of the Bullfrog pit + 8 nearby mill site claims.

- 2017/18: Leased 24 patents, staked 134 claims & purchased 2 patents.

It’s important to note that the Bullfrog Gold Project is an advanced “brownfield” project with supporting infrastructure in-place including power to the site and a paved highway leading right up to the front gate of the property — a true rarity in the junior mining space.

The company raised C$2 million back in January to fund the recently completed drill program and to perform environmental studies, bulk sampling, and metallurgical testing.

The primary exploration targets are the Bullfrog and Montgomery-Shoshone pits.

Additionally, the company’s geologic team has identified a brand new gold/silver target in the Paradise Ridge zone.

The Paradise Ridge target was developed through extensive surface sampling coupled with the recognition that 1.) the host rocks are identical to those in the Bullfrog deposit, 2.) significant structural features are present, 3.) surface samples contained gold, and 4.) previous drilling by other operators is too far east and west for adequate testing of the target.

Remember, the Bullfrog Gold Project is not a drill-and-hope venture. It’s an advanced-stage project with a 43-101 Measured and Indicated (M&I) resource of 624,000 ounces of gold at an average grade of 0.70 grams per tonne and 1.73 million ounces of silver at an average grade of 1.93 grams per tonne.

There’s also an Inferred resource of 129,000 ounces of gold and 285,000 ounces of silver at similar grades, plus potential for significant resource expansion by way of the drill-bit.

155 Miles of Drilling!

Bullfrog Gold has full access to Barrick’s detailed database of 155 miles (Yes, I said miles!) of previous drilling across some 1,200-plus holes. We’re talking about a vast drill database that would cost upward of $45 million to recreate at today’s costs.

Naturally, a database of that size and detail is only of value in the hands of a highly-experienced geologic team with the know-how to put it to good use.

To that end, I’m excited to introduce you to Bullfrog Gold president & CEO, Dave Beling — a Professional Mining Engineer and industry veteran of 56 years who’s literally done-it-all in the mineral exploration business.

As you’re about to discover… the team is in-place… the pits and infrastructure are in… and momentum is building on all fronts.

The immediate development plan is to expand the known resource at the Bullfrog and Montgomery-Shoshone and exercise the option on the property with Barrick.

Mr. Dave Beling explains all of that, and a lot more, in detail below:

Interview with Dave Beling

President & CEO of Bullfrog Gold Corp.

Mike Fagan: Dave, great to catch up with you during this very important development stage for Bullfrog Gold Corporation. Yet, before we get into the specifics of the Bullfrog project and the recently completed drilling, would you mind briefly describing your mining background which is quite extensive to say the least.

Dave Beling: Mike, great to be with you as well. As you know, I’m a registered Professional Mining Engineer from the University of Arizona, and this year marks my 56th year in the business.

I’ve spent quite a bit of time in copper, uranium, gold and silver, as well as cobalt and nickel. I’ve been involved with developing several gold heap leach projects, including the Hycroft Resources project in northwest Nevada. I finished construction on that in the late ‘80s and ran it for 5 years. So I’ve been around the block.

I’ve also developed several corporations doing IPOs, bank financings, offtake agreements and so forth. So yeah, I’ve got over half a century of experience, including permitting. In fact, I developed, or at least championed, the issuance of the first Environmental Impact Statement (EIS) for a mine in the state of Arizona.

The only thing I haven’t done in this business is smelting.

MF: That’s a heck of a background. And frankly, you're being a bit modest. I know you've engineered and/or managed 12 open-pit mines, 9 underground mines, 14 process plants. I could go on and on.

All of that is important because not only does the Bullfrog Gold Project have a 43-101 resource, it also has a drill database that I think is literally worth its weight in gold. Tell me about the project and how it came about.

DB: Mike, we had an initial land position next to Barrick back in 2011 when the company was started. Since then, I’ve done deals with Barrick and several other companies. We’ve staked 134 claims, purchased several patents and so forth.

Whereas we essentially had a land position and zero ounces back in 2011, we now have over 5,250 acres of patented and unpatented claims and a 43-101 resource estimate of about 525,000 ounces of gold Measured & Indicated (M&I) at around 1 gram per tonne.

Plus, we’ve got another hundred and some odd thousand ounces in the Inferred category that we believe has very good potential for expanding the resource and specifically within the existing pit plans. So there’s quite a bit of build-up on the land and resource.

In addition to the potential for expanding the pits that Barrick mined, we’ve generated a new previously undrilled exploration target just one mile east of the main Bullfrog pit — called the Paradise Ridge target. This area has the identical host rocks as the Bullfrog deposit. It has gold on the surface, and it has structures in it.

As you know, we just completed a 25-hole drill program. The majority of the drilling was in and around the Montgomery-Shoshone (MS) and Bullfrog pits plus two holes in the Paradise Ridge target.

So that’s how this project has come to where we are now. We’re quite enthusiastic with what we have. We have a two-pronged project. We have two existing pits that we believe will become mines, plus we have exploration potential.

So we’re focusing on both of those things and doing them concurrently.

MF: Well, you’re also in the right address. You're right next to what was Northern Empire’s project before it was acquired by Coeur Mining for US$90 million.

Can you speak to your proximity to several majors and peers? Because I have to believe, just looking at the list, that you likely have the smallest market cap of anyone in the area-play.

DB: Well, that’s correct, Mike. We’ve got the heart of the Bullfrog area that Barrick mined. They produced 2.3 million ounces out of this area. We own or control the northern third of the Barrick Bullfrog pit. And we also have the entire Montgomery-Shoshone (MS) pit that Barrick mined.

But gosh, over the past several years, AngloGold Ashanti has taken a position from Renaissance Gold; they exercised a $3 million option and they've staked additional claims. They've staked claims up to the northwest of our main claim boundary. So has Kinross Gold and so has Corvus Gold. And as you mentioned, Coeur took over Northern Empire.

So there’s a lot of big players in the area. The Bullfrog Mining District is actually one of the hottest gold exploration plays in the United States — if not, all of North America.

MF: Agreed. Dave, I also like to see management teams with significant skin in the game, and you definitely have that.

DB: Well, I’m the largest shareholder. I’ve got 30 million shares, and I’m the largest creditor. I carried this company out of my own wallet for three years when gold was a lot less than it is now.

I tell everybody, ‘My wife thinks I’m crazy,’ but that’s not a recent occurrence (laughs!).

Yet, in any event, my objectives are totally in line. And there’s not that many CEOs that have that kind of ownership in a company. So I definitely believe in this, and I’ve continued to put my money where my mouth is.

I think that’s a big deal.

We have two other directors; Alan Lindsey and Kjeld Thygesen. We’ve all known each other for over 27 years, and we’ve all been in the mining business a long time; Kjeld for 48 years and Alan for 26 years.

So we have a well-seasoned board, and we have several consultants and other people that contribute to the entire team. We have a lot of contacts that we can draw upon as we expand our exploration and development activities.

MF: Can you talk a bit about the current market cap in relation to the 43-101 resource? I think you have a very favorable ratio there.

DB: Right. We’ve got about 157 million shares out of common. We also have 20 million preferred that are readily transferable to common at parity.

Our market cap sits at about US$27 million, including both common and preferred. So that’s where we’re at. We’re obviously undervalued.

In fact, when you look at our market cap per ounce of gold of Measured and Indicated resources in the ground, we’re around $40 an ounce. Many peer companies are at $100 per ounce or more.

So therein lies the opportunity with Bullfrog Gold.

MF: Let’s talk about the drill database you’ve acquired from Barrick. I understand you have over 250,000 meters of drilling data. I imagine that’s helping to refine targets moving forward.

DB: That’s exactly right, Mike. We copied all of Barrick's drill hole files. In mileage, it was 155 miles of drilling. We’ve analyzed every single hole, in some cases many times over… extracting everything possible on generating exploration targets.

That drilling also supported an independent 43-101 resource estimate that was done back in 2017. Barrick's geologists, as you know, are as good as they come. That information satisfied Tetra Tech as far as their due diligence on supporting that type of 43-101-compliant resource.

So the database is massive and vitally important.

We have access to all of their data. I’ve been to their Elko and Salt Lake offices, and I’ve looked over everything in great detail. Ultimately, when we exercise our option to purchase those lands, we’ll acquire that information and store it in our own facility.

So it’s a huge database. And the biggest value, obviously, is the 155 miles of drilling. In fact, it would cost US$45 million or more to recreate that drill database today.

MF: What’s the infrastructure like at the Bullfrog Gold Project, Dave?

DB: Gosh, Mike, it’s located 4 miles west of the mining town of Beatty, Nevada. There’s a paved highway leading right up to the front gate of our property. We have ample water under the Bullfrog pit. There’s a power line onsite and a substation site that Barrick used.

These pit walls have been standing at 53 degrees for over a quarter of a century. The original deposit had 2% or less sulphides in it, and the bulk of that has been oxidized thoroughly, so you don't have any acid mine drainage.

Those things, compared to a greenfield project, are a big deal.

The Bullfrog pit – from the top of the mountain to the bottom of the pit – is around 1,200 feet. The Montgomery-Shoshone (MS) pit is about 400 feet deep. Ramps are already in-place. In fact, you can drive all the way down to the bottom of both pits.

So that kind of infrastructure is a real blessing and attribute for us.

MF: No doubt, it definitely goes a long way having that type of infrastructure on someone else’s dime. Dave, What’s next for Bullfrog?

DB: We did our lease with Barric a little over 5 years ago and we had to spend a total of $1.5 million dollars. The recent drill program completed that requirement and then we'll exercise the option to purchase 100%. It's still subject to royalties. Barrick gets a 2% royalty on that, on their lands.

We've got some significant horsepower involved in this thing to guide us on the future of our exploration of these targets. We may have to drill a few more holes to ultimately get the pit limits where we want them. But I also intend to put a couple more core holes in the Bullfrog pit in particular so we have enough metallurgical representative samples to support the very high recoveries we've achieved, which were 85% using high-pressure grinding rolls.

That's a good chunk of our path forward. Of course, we also want to do a preliminary economic analysis where we have independent capital and operating costs, optimized pit plans and then financial models that demonstrate the robust economics that we anticipate from this project.

The SEC and 43-101 require using a 3-year trailing average gold price in resource estimates and economic studies. But right now the 3-year trailing average today is about $175 higher. The spot price as we now know is over $2,000. If we were to do a PEA independently today, they would be using about $1,375 gold.

We've got a lot of additional work on planning on the next step forward, but we've outlined all of this in detail in our 3-year budgets, where you go through additional drilling, additional permitting. Permitting for the production operation is going to take a lot of baseline studies to update already what's out there. Then you get into a feasibility study and you're talking about some real money and time, but these are the logical sequences to go through to advance this project. With the kind of results we're getting and with the gold price, this thing is sailing in very smooth but quick water.

MF: Dave, I really appreciate the time, and we’ll be watching your company’s developments very closely!

DB: It’s been my pleasure, Mike.

A Golden Opportunity

In the resource sector, you’re only as good as the people running the show. And I have every confidence in the Bullfrog Gold team – led by longtime mining exec, Dave Beling.

The company has amassed an impressive land and resource position in a resurgent gold/silver area-play in the Bullfrog Mining District, Nevada – and the timing could not be any better.

As you can tell from the 12-month chart below, the yellow metal is in a confirmed bull market and looks primed to test all-time highs north of $2,000 an ounce in short order.

As noted, Bullfrog Gold raised C$2 million back in January of this year to fund the recently completed drill program and to perform environmental studies, bulk sampling, and metallurgical testing at its Bullfrog Gold Project.

That raise was done at C$0.13 with a half warrant at C$0.20 for two years.

New shareholders came into Bullfrog Gold in that placement, including former executives from Northern Empire (the company that was acquired by Coeur Mining for US$90M and whose property lies just to the southeast of Bullfrog Gold’s claim block).

Another company, Owl Capital Corp., owns approximately 5% of Bullfrog Gold. Owl Capital is run by Ron Netolitzky and Dale Wallster. Ron was PDAC (Prospectors & Developers Association of Canada) Prospector of the Year in 1990, Developer of the Year at the BC & Yukon Chamber of Mines in 1996, and was inducted into the Canadian Mining Hall of Fame in 2015.

He also oversaw the transformation of Viceroy Exploration Ltd. (Castle Mountain Mine), Loki Gold (Brewery Creek Mine), and Baja Mining into Viceroy Gold, a 200,000-ounce gold producer, which, after the development of the Gualcamayo gold project in Argentina, was ultimately sold to Yamana Gold. Dale Wallster and his team at Roughrider Uranium discovered what became Hathor’s Roughrider uranium deposit, which was sold to Rio Tinto for C$650 million.

The reason I bring this up is because it shows strong industry backing for Bullfrog Gold from strong industry players.

Bullfrog Gold will likely have to raise additional capital later this year or early next year — ideally at higher prices on the back of further positive field results.

Now is an opportune time to begin conducting your own due diligence on Bullfrog Gold Corp. (US-OTC: BFGC | CSE: BFG) as a timely opportunity in a rising gold market.

The company’s shares are currently trading around US$0.25 per share with major development initiatives ahead.

Yours In Profits,

Mike Fagan, Editor

Resource Stock Digest

PS: Be sure to visit the company’s corporate website at www.BullfrogGold.com.