Can You Ride a Heliostar to the Moon?

Alaska’s First Underground Mine Could Soon Be Its Newest

The company behind it sees a clear path

to one million ounces of high-grade gold.

Heliostar Metals (TSX-V: HSTR)(OTC: HSTXF)

There’s an often quoted saying in mining: “The best place to find a new gold mine is in the shadow of the headframe.”

In other words, you don’t need to explore too far from an existing mine to make a new discovery.

But for Heliostar Metals (TSX V: HSTR)(OTC: HSTXF), they don’t need to go any further than the old mine itself.

Heliostar is a C$47 million junior gold explorer. It emerged in October 2020 from the merger of two exploration companies, Heliodor Metals and Redstar Gold.

Charles Funk, the new company's CEO, is one of the brightest young geologists in the sector today. He's the former Vizsla Resources (TSX-V: VZLA) VP Exploration, where he helped drive the company's success at its Panuco silver and gold project.

Now he’s three months into his first CEO position and he has an awesome set of projects to work on.

Unga Project, Alaska

The new company’s flagship project is Unga in Alaska. And they also have several impressive exploration projects in Mexico.

The Unga Project is on Unga and Popof Islands in Alaska’s Aleutian chain. The islands sit near the bottom of the Alaska Peninsula and approximately 900 kilometers southwest of Anchorage, Alaska.

Gold prospecting and mining on the islands dates back to the 1890’s. Prospectors discovered gold on the southeast side of Unga Island in 1891.

Two mines — the Apollo gold mine and the Sitka gold mine — reportedly operated between the late 1880s and the early 1920s.

Alaska’s first underground mine, the Apollo mine, produced between 100,000 and 130,000 ounces of gold. Historical reported grade for the production ranged from 7.0 grams per tonne to 12.8 grams per tonne gold.

The nearby Sitka mine operated between 1900 and 1922, but gold production was limited to a few thousand ounces. Both mines produced gold from the upper, oxidized portions of sulfide-rich ore deposits.

That gold was “free-milling”. That means they broke up the rock and the gold just fell out.

However, beneath that was gold locked in sulphide minerals. They couldn’t recover that gold with the technology of the day, so they closed the mines. All the gold in sulphide is still just sitting there, waiting.

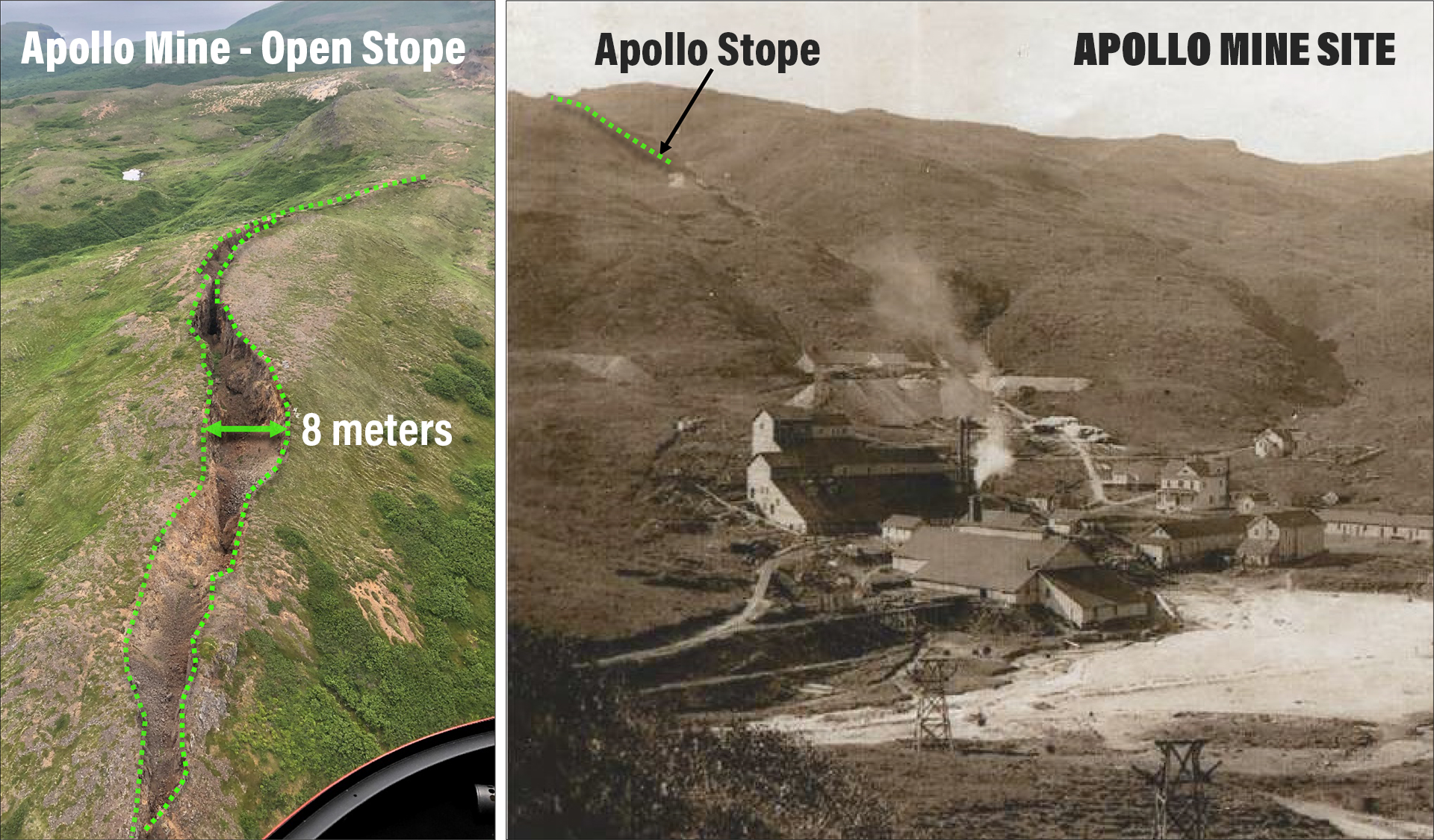

When the mines were operating, supplies and personnel were shipped directly from San Francisco and Seattle to site by oceangoing barge. There are some outstanding historical photographs of the mines and the town:

The Unga project appears to offer a near-textbook example of a high-sulfidation to intermediate-sulfidation gold target. It is a prospector’s dream come true. It holds more than 25 distinct showings of gold, silver, and base metal mineralization. It runs the gamut from high-grade gold in quartz to large, porphyry-copper and gold mineralization.

There are two major faults that acted as conduits for the gold mineralization in the region. They form long corridors that run southwest to northeast across Unga island and extend onto Popof Island.

To date, geologists mapped the exposed portions of the fault corridors over 10 kilometers long and up to 1 kilometer wide. That’s an area roughly a quarter of the size of Manhattan Island. And the whole region has the potential for gold deposits. The rocks show all the hallmarks of good host material – thick quartz veins, breccias and stockworks.

There are several secondary faults that cut the main faults at an angle. These intersections offer opportunities for gold mineralization, yet few had attention in the past.

This is a huge, district scale target area. And up to now, many operators held small pieces. They each held a postage stamp of ground, which prevented any of them from doing regional-scale work.

In 2011, Redstar Gold Corp tied all the ground together. But a plunging gold price sent the company into a tailspin. They could only muster a tiny budget to explore the ground.

Back in 2017, the company raised money to explore a specific target at SH-1. However, they didn’t make the big discovery they wanted.

The merger with Helios Gold in 2020, now Heliostar, brings a whole new scope and process to exploration at Unga.

Today, Unga represents an incredibly promising district scale exploration project with known high-grade gold. It’s a target rich environment for Heliostar’s outstanding technical team.

The company recently announced success from its 2020 drilling program. It announced the first two holes in its nine-hole program at Unga:

SH20-01A - 7.74 grams per tonne (g/t) gold and 27.0 g/t silver over 11.65 meters (m) from 12.95 m downhole. That includes 16.06 g/t gold and 37.7 g/t silver over 4.0 m from 12.95 m downhole

SH20-02 - 18.66 g/t gold and 11.5 g/t silver over 1.98 m from 50.75 m downhole

These drill holes targeted the SH-1 target at Unga. It holds an existing inferred resource of 384,318 ounces of gold at an average grade of 13.8 grams per ton.

The company will use the data from its 2020 program to tailor a C$4 million drilling and exploration campaign at Unga starting in the second quarter 2021.

La Lola and Oso Negro Projects, Mexico

Heliostar plans to shift its attention to Mexico in the Spring of 2021. It has a modest C$600,000 exploration program planned across its three early stage projects.

Heliostar has a pair of exciting projects in the Sierra Madre in northern Sonora State, Mexico. This region contains a large number of large, high-grade mines and discoveries.

Both La Lola and Oso Negro sit in an incredibly rich region. Their neighbors include Premier Gold’s Mercedes mine, First Majestic Silver’s Santa Elena mine, Silvercrest’s Las Chispas deposit, Southern Copper’s giant La Caridad mine and Silver Tiger Metals’ El Tigre deposit.

La Lola is a 63.6 square kilometer land package that includes the historic La Barra vein. The company mapped a 5-kilometer-long section of the carbonate-fluorite vein with samples containing elevated gold and silver, as well as pathfinder minerals. The company believes that the vein is the top of a system that is enriched in gold at depth. The La Barra vein should provide a rich target for exploration this spring.

The Oso Negro project sits roughly 50 km southwest of La Lola and 40 km northeast of Silvercrest’s Las Chispas deposit. It hosts three highly prospective vein structures.

- Northern vein runs east-west for roughly 500m. It contained a grab sample of 17.5 g/t gold and 1,935 g/t silver.

- El Sahuaro vein runs northeast – southwest, just south of Northern vein. El Sahuaro yielded a surface sample of 100 g/t gold and 2,680 g/t silver.

- The North-South vein is southeast of the other two main veins and runs north-south. Its highest-grade sample ran 3.4 g/t gold and 1,905 g/t silver.

The project bears many similarities to its neighbor, Las Chispas. That project had similar grades and vein styles at surface. Today it holds over 1 million tons of resource at an average grade of just under 7.0 grams per ton gold and 1,234 grams per ton silver. However, Oso Negro is still at the grass roots stage of exploration.

As with La Lola, it holds enormous promise for this spring’s field season.

In order to get more color on what’s in the future for Heliostar, Resource Stock Digest’s Gerardo Del Real sat down with CEO Charles Funk.

Heliostar Metals (TSX-V: HSTR)(OTC: HSTXF) CEO Charles Funk on High-Grade Gold Intercepts at Unga Project in Alaska & Mexico Gold Portfolio Update

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is the CEO of Heliostar — Mr. Charles Funk. Charles, how are you today?

Charles Funk: I'm very well, thank you. Thank you for having me.

GDR: Thanks for coming on. You're actually developing an asset in my former neck of the woods. I lived in Anchorage, Alaska, for 17 years. My wife was born and raised in Alaska and, of course, the flagship is located in Alaska.

And you had some excellent news that I want to get into here in just a bit. But before we get into that, could you do me a humongous favor and just give us a brief overview of your background because it's a pretty successful one.

CF: Thank you. My background started out in Australia working for mid-tier and major copper explorers and gold miners, most notably Oxiana, OZ Minerals, and Newcrest. And particularly when I was with Newcrest, I got a lot of opportunities to travel to North and South America… and that's how I first came to Alaska.

And so I did that for a number of years and got a little bit frustrated with how big companies work and how difficult it was to find things that move the needle. And so I wanted to be a bit more entrepreneurial. So my wife and I moved to Canada nearly five years ago, and I started as VP for a prospect generator called Evrim which introduced me to Mexico.

And during that time, I was fortunate enough to be involved in copper discoveries in Australia and then gold and silver discoveries in Mexico — most recently as VP of Exploration for Vizsla.

And we had tremendous success last year on the Panuco project. But all the while, I always wanted to build a company that had a nucleus of a fun management team to work with but a serious long-term goal of building a serious scale company.

And so I’d always focused on projects that had significant upstarts. And so I founded a company called Heliodor eighteen months ago backed by a number of high net worth individuals. And we picked up some early-stage but quite attractive projects in Mexico, that we might get time to talk about, and went looking for that flagship asset.

And early last year, got talking to Redstar on their Unga project in the Aleutian Islands in Alaska. Long story short, we agreed to merge our access to capital and knowledge of these systems combined with Redstar having the asset and needing a catalyst to bring that share structure back to a more investable state.

That meant Redstar acquired Heliodor, and we consolidated the capital structure. We raised C$7 million. We rebranded as Heliostar. We undertook a drill program which is where we have the results from. And so today, we have a whole new company called Heliostar with some very high-grade, very attractive projects.

GDR: The flagship asset has a resource. I believe it's approximately 384,000 ounces at a grade of 13.8 grams per tonne gold. You had some news today that I think underscores how attractive that project is. Let me read the headline:

You drilled 16.1 grams per tonne gold over 4 meters within 7.74 grams per tonne gold over 11.65 meters.

You mentioned your success and experience with Newcrest. Obviously, Newcrest is known for drilling deep, drilling high-grade, drilling methodically. You were successful there.

Walk me through the approach of drilling out this flagship asset and what that looks like here because you have multiple catalysts, multiple irons in the fire here in the near and the mid-term that should be pretty exciting for anybody looking for a new gold play with quality management. And as you mentioned, the quality share structure with just 31.6 million shares issued and outstanding.

CF: Yeah, you've summed up the strategy really succinctly. Unga is an amazing project because of its history. It had a lot of quality exploration in the 80s particularly by Battle Mountain. But then there's almost been a 40-year hiatus with no systematic follow-up.

Some of that comes about because it spent nearly 15 years in an oil and gas company. And then for other reasons… some including even the passing of the former CEO or Redstar’s initial focus on the Red Lake District.

Then outside of SH-1, this huge district has seen very, very limited exploration. And that's highlighted at SH-1 by the fact that you've got this high-grade resource that is wide open… and we’ll talk about our drilling in a little more. But the deepest hole at SH-1 is 5.5 meters at 24 grams. That hole was drilled nearly 14 years ago and, to this day, has never had any drilling in it. It's incredible!

GDR: Interesting, interesting. When you look at the corporate presentation and you see the project is 100%-owned… but for those that haven't been to Alaska, when you see that you fly into Anchorage and then you fly out of Anchorage into Sand Point… I've been to Sand Point.

But for those that look at the presentation and say, "Well, this is an Island. How are you ever going to develop this project?" Can you provide the audience a bit of context as to the location and the infrastructure of the project?

CF: Yes. So you're right. It is a remote project. It's in the Aleutian Islands and in the far south of Alaska. But it's surprisingly accessible. There's a major airstrip at Sand Point with regular international and charter flights. It actually comes with a huge advantage. And when people think of Alaska… they think cold, frozen, short field seasons. We can drill nine months of the year at Unga.

In fact, we finished drilling at the end of November last year and we plan to re-mobilize in late-March. So it gives us a tremendous advantage from that perspective. The other surprise is that it was Alaska's first underground gold mine. And we'll talk about the Apollo target shortly. But they mined that from the late-1880s to the early-1920s. So it's actually a brownfield site.

In fact, the island of Unga – we’re under our claims, it’s about 10 by 13 kilometers – and it is approximately sort of twice that size. It's quite a big tract of land. It's got roads connecting our major targets. It used to have a town that finally they abandoned in the late-50s as a consequence of the mine shutting down in the late-20s. And so for a project in remote Alaska, it's got surprisingly good infrastructure. They've got a port, road, and it's accessible.

GDR: You mentioned Apollo and I think it's important for people to understand that this has historical production and the metallurgical work indicates you have pretty good recoveries there. And that's important, right?

You can have grade and great rocks, and, at the end of the day, you may end up with a pretty countertop! The met work is important. Can we talk about the history of that target?

CF: Yeah. In fact, it probably is worth wrapping into a broader history. So I won't bore too much on the geology but this is an amazing property. It's got porphyry targets; it's got bulk-tonnage gold targets as well as these high-grade mines. And the nature of these high-grade mines is intermediate sulfidation.

And effectively what that means is it starts off gold-rich in shallow levels. And as you go deeper becomes more silver and then gold-silver base metals at-depth. And so the opportunity at Apollo is the old timers mined 130,000 ounces at about 10 grams per tonne. So quite a profitable operation.

But they didn't understand that model and that transition. And so as they went deeper in — they started getting sulfide. And so they called that complex ore, which, with stamp mills in the 20s, was uneconomic to recover.

In fact, I've mentioned a couple of times… they looked at producing a concentrate and they would've got penalized for their zinc. So the world's changed a lot in a hundred years.

They're struggle is our opportunity because as they went deeper, they dug their shafts, they dug these exploration tunnels, and blocked out these zones of mineralization anywhere from 20 feet wide, 8 meters wide. Under Apollo… I think there's a 100,000 tonne block under the shaft area that they've shown the location of.

And they went one step further and estimated the grade. They said, on average, you'll find 3 grams gold, 250 grams silver, and 10% combined lead-zinc. So you've got an old mine that they tell you the mineralization continues underneath; they tell you the grade, which is about 8 to 10 grams gold equivalent. And from that day until we started late last year, no one had ever drilled under those workings.

GDR: You announced the first 2 of 9 holes that you completed at the SH-1 Zone today. The grades, obviously, were excellent. The widths, which I should say represent, I believe, true widths, right… true thickness is estimated at 80% to 85%. Is that accurate?

CF: Yeah. So the true widths are approximately 80% to 85% of the announced widths so really robust. So SH-1; there’s two major vein zones at Unga. We just talked about Apollo. To the north, a few kilometers, there's a parallel vein called Shumigan. And the best advanced zone, which we touched at the top of the interview, is the SH-1 ore shoot.

And so the drilling there has this core area that's been quite well-grouped. It’s got holes in it like 17 meters at 24 grams per tonne gold. But when we had a close look at the resource as part of our due diligence for the merger, there's three opportunities very clearly.

The first is there was a 100-meter gap from surface to the first pierced points into the vein. And so we completed 7 shallow holes last year. And so the first of those results on 50-meter step-outs, we announced, as you mentioned, the 11.65 meters at 7.7 grams including 4 meters at 16 grams and Hole-2 that had nearly 2 meters of 18 grams.

So spectacular high-grade above what is already a very high-grade resource. And we're expecting the rest of those results throughout February, maybe into early-March. We suffered from lab delays like everybody else.

Another real opportunity is, as we step down into the vein, the drilling becomes really loosely spaced. Consistently, 100 to 300-meter spaced drilling. And that's not the appropriate way to drill an epithermal like this. It doesn't give you a lot of confidence in the results and also leaves a lot of answers behind because you've got a low result in an area that hasn't had enough follow-up because you can easily get low results in the middle of ore shoots.

And so we think by infill drilling, we can increase the confidence of the resource and very likely add quite significant ounces particularly on some of the parallel zones that you can see in the long section on the company presentation. And then, extending the ore shoot to-depth below the very high-grade intersect that I just mentioned.

So we think we could increase the resource of SH-1 to 0.5 to 1 million ounces. And that'll be a real focus for us in 2021 at Unga.

GDR: What are your plans for follow-up drilling? Obviously, the delays from the labs is an industry-wide headache that everybody has had to deal with. But are you waiting to receive the remainder of the assays before you put a plan together to follow up the drilling and pivot towards that goal of 1 million ounces, high-grade gold ounces, in Alaska?

CF: Yeah, you're correct that it has been a little bit of a frustration to wait that time. But no, we're not resting on our laurels. We're fortunate that we're well-financed with C$5.5 million worth of cash and short-term investments.

So we completed 23 holes last year. We hit the vein that we were targeting in 19 of those 23 holes; that's spread across SH-1, Aquila, and the Apollo trends. We've received results, as of today, now from three of those holes. So we have quite a significant number of holes outstanding.

But with the funding, we've already committed to going back to start in mid- to late-March. And we're going to plan a two-phase program. The first covers what we've just spoken about in systematically stepping out of SH-1 and also doing the same at Apollo where we've intersected the vein underneath those old workings. And we think that could be an initial pathway to the 1 million ounces of high-grade material.

And then phase two is to do systematic geophysics, mapping; generate a lot more targets and drill anywhere up to 20,000 meters to really unlock the potential of this district because it has some of the highest probability exploration targets that I've seen in my career.

GDR: Well, that's a pretty big endorsement considering your experience there, Charles! Let's talk Mexico a bit. You also have three properties in an emerging district that I'm very familiar with actually.

One of my first resource investments was in a company that owned the Santa Gertrudis Project that Agnico Eagle now owns. And, of course, that's near Cananea that Grupo Mexico owns and several other producing mines. Can we talk about the exploration portfolio in Mexico?

CF: Yeah. So the reason that we've balanced our portfolio between Alaska and Mexico is there's a perception from investors that, if you're focused in northern Canada or Alaska, that you can trade around the field season and sell towards the end of the year and then think about coming back in early the next year.

And so we have two lines of defense there. The first is that long nine-month field season you and I talked about. The second is that portfolio in Mexico. And I share your sympathy for this part of the world.

I’ve spent a lot of time in the last few years in northern Sonora in particular. I was fortunate enough to be involved in the Ermitaño discovery, which is about to go into production with First Majestic. It’ll probably be a 1 million ounce gold equivalent ore shoot when all is said and done; 3 kilometers east of the Santa Elena mine.

And as I mentioned, also led the Panuco discovery with Vizsla last year. And so I've got a lot of exposure to the prospectivity of vein systems in Mexico. And you mentioned the big copper porphyries. This part of Sonora has always been held by the copper miners. And it's only in the last 10 years that the gold and silver endowment is really being recognized.

You mentioned Santa Gertrudis, which is a priority development project for Agnico. We all know Las Chispas and Santa Elena and now Equinox at Mercedes; it's produced over a million ounces.

But multiple mines that produce from high-margin vein systems are within about 50 kilometers of our three projects. And so we plan to drill at La Lola in February. La Lola is a large epithermal district that I actually staked in a previous role.

It's got a vein that gets up to 14 meters wide on-surface. It's got some really nice samples on it like 58 grams per tonne gold and 424 grams per ton silver. But there's not widespread mineralization at-surface.

And when you understand the geology, it makes sense. You're at a shallow level in the system, and you want to drill deeper to where it might be more prospective. And so we'll be drilling that in February and we'll be sharing some more news with our shareholders and your listeners over the next few months.

We've got a second project called Oso Negro that’s got spectacular grades on-surface. It's got three veins each over 500 meters long with 200 [grams] to 2.5 kilos silver grades; one with 10 gram gold grades with that. And we just need to do some more systematic mapping and sampling before we refine our drill holes.

And then given that this is a sort of an interview or conversation… a bit more of a story around our third project, which is Cumaro. I always liked the old Picacho district. It shows a lot of potential. And I started by acquiring the primary claim block with a view to putting the whole district together.

And my glass-half-empty, glass-half-full narrative for Primero is that, unfortunately, we didn't secure the entire district. That is because SilverCrest comprehensively out-bid us in late-August last year. They had much deeper pockets than we had at the time.

And so the glass-half-full is everyone knows SilverCrest’s reputation in this part of the world. N. Eric and Rosy and the team have done a fantastic job. I think they saw the same potential that we did. And so glass-half-full, we have the key part of a really attractive district, and we're doing some mapping and sampling on that at the moment.

GDR: You have assays pending in Alaska. You're drilling in Mexico in February. You'll have assays pending there. You're cashed up. You have the structure; you have the team. It's a good looking company. Is there anything else that you'd like to add, Charles?

CF: No, I think that's a really good summary. So the last part is the team. In the last few months, we've really built out our team. Sam Anderson joined us after 17 years with Newmont as VP of Exploration.

We've got a new exploration manager, new corporate manager, new CFO, and Rob Grey has just joined as our IR manager with a very strong track record in new discoveries. So we think we've got a really robust team, and we're really aggressively unlocking the potential of our portfolio.

GDR: Well put. Charles, thank you so much for your time. I'm looking forward to keeping up with the story in future updates. Thanks again.

CF: No worries. Thank you and thank you to your listeners.

Conclusion

Heliostar Metals (TSX-V: HSTR)(OTC: HSTXF) is one of the few companies still below C$100 million market cap with these kinds of projects.

Because of its late 2020 arrival, it missed most of the run up in junior mining stocks.

It has a fantastic management team. Its leader is one of the premier young geologists in Canada. And he and his team assembled an attractive group of high-grade gold and silver projects.

They have skin in the game, owning over 21% of the company’s 31.6 million shares outstanding. And that isn’t the only share structure advantage. There are very few warrants issued as well, making it extremely tight and able to move.

The first bit of news out on Unga demonstrated the success that we expect to see continue. And the Mexico projects represent some outstanding “home run” potential for bonanza grade gold and silver.

In all, this is an extremely undervalued junior mining company.

There are companies trading for four or five times as much, with a fraction of the potential Heliostar possesses.

Learn more and sign up to receive updates directly from Heliostar at its website here.

— Resource Stock Digest Research